Usually requires some effort if you want to organize finances and many people are not measured at the time of spend. To get more money has to start control your spending and maintain order.

Then 6 practical steps that will help you get your personal finances in order:

– It should be clear what your monthly income is. Some people know how much is his salary but do not know the value after deductions such as health, pension received, among other contributions. If you live with your partner is very useful to make reflection to know what the monthly household income. Include premiums, bonuses or any extraordinary income.

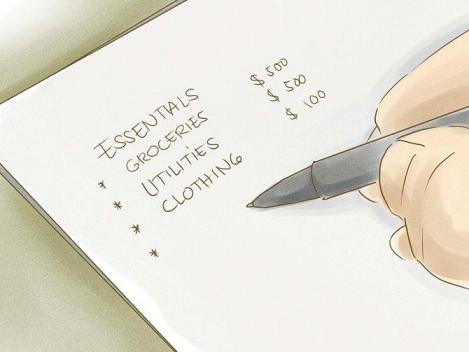

– Make a list of monthly expenses (rent, mortgage payments, loan payments, food, utilities, schools, college, and gasoline taxes). Try to be as detailed as possible and allocation each of these costs a figure. Necessary for instance call the bank and find out how much the balance of your debt. Don’t forget the small or sporadic expenses that also added as a way out to lunch, going to the movies, buy any product for the house, go to the salon, among others.

– Try to go in line with the budget that was set for each of your expenses without going over. At this point it is important to fulfill expenses especially fun, where you can spend the line with ease. Although representing a sacrifice at the end of the month you will see that there is a balance in red and can even start saving.

– Bank credits can get you out of trouble, but remember that you must replace money with interest. Within budget as much as possible target a percentage for unforeseen, because although small can help you be more comfortable with your finances.

– Select priorities as those expenses that shall pay each month and spread the money once you receive your salary. You can also make a list of products you need for example to avoid repeating the supermarket or buy items that you do not need.

– Each month can have a cost not expected (go to the doctor, to repair an appliance or car, buy a dress for a social event). Ideally you would have extra money to pay these costs and avoid using, for example, the credit card. Saving is always welcome and doing so wise will see the reward.